As a business owner, you understand whether or not you’re turning a profit. But do you know which clients (or projects) are generating that profit? Or worse, cutting into it?

If not, you’re not alone. While most owners/managers of professional services firms can readily identify costs and what they’ve invoiced clients for each project, many don’t know how to assign those same costs to different projects.

With our background at Heath Advisory, we see it all the time – advertising agencies or law firms know what their income statement says, but they don’t know how to determine which projects or clients are profitable.

On its face, it seems easy enough: Revenue minus expenses equals your net income (or loss). It’s simple math – to improve your bottom line, you can either increase your revenue, or decrease your expenses.

And no question, you need to know those numbers. But if we peel back the onion, you also need to know which projects are beefing up your bottom line, and which ones are pushing it in the wrong direction. Project and client profitability are powerful key performance indicators (“KPIs”) for marketing agencies and other professional services firms.

Not cans of soup, but cans of time

For companies that buy and sell products, pricing and detailed profitability analysis can be pretty simple – let’s sell the widget for more than we paid for it. For marketing agencies and other firms that provide services (instead of marked-up widgets), a few more steps are required to understand whether a project or client relationship is profitable.

This is where some simple cost accounting can make a world of difference.

Cost accounting is the part of management accounting that us pocket protector-types use to determine the cost of a product or service.

At Heath Advisory, we encourage our clients that run service-driven businesses to think of the number of hours their teams have available to serve clients as their inventory. Revenue-generating hours (think: client hours) are called direct hours. You can use cost accounting to determine the cost of each one of those hours – just like units of inventory.

When your team tracks their time by project and client, you can see who worked on what and determine the cost of the project, or cost of the overall client relationship. Once you know those numbers, you can subtract those totals from the revenue you took in and determine whether the project (or client relationship) is profitable.

Say it together: Track. Your. Team’s. Time.

Wait – did you say time tracking? We don’t track time. Since we don’t bill by the hour, and since we charge our clients flat fees or media commissions, we don’t track our time.

Your team’s time is your agency’s inventory. That simple fact alone argues for tracking your time. Beyond that, understanding the cost of each hour worked by each member of your team provides insight into many critical aspects of your professional services firm.

All of our experience with professional services firms – and that’s a lot – argues for tracking time. Whether or not you bill by the hour, we believe you should be tracking your time and requiring your team to do the same. (We’ll get off that particular soapbox now.)

I’ll have a cost rate, fully loaded, please

Now that you’re tracking time, you need to assign a cost rate to each team member.

We recommend using “fully loaded cost rates.” This is a way of saying that we’ve taken almost all expenses of the business and allocated them to our employees, so that their hourly cost rate includes some fraction of the annual expenses of the business. The result? The cost of all hours worked, plus any costs excluded from your rates, will equal the total expenses, per your P&L.

There are many ways to determine your cost rates, but we’ve found this to be the simplest approach. You can complicate the hell out of this thing – or keep it simple. All other things being equal, we favor simple. Less brain pain, and certainly better if you’re embracing cost accounting for the first time.

A simple example (no calculator required)

Here’s a simple example using round numbers. You can add or subtract zeroes to make it more pertinent to your business.

We’ll call it Acme LLC. It could be an ad agency, a law firm, a medical practice, or any other professional services firm.

Last year saw Acme bring $3.1 million in revenue. They incurred $2.1 million in expenses. (We’ll get to what constitutes those expenses in a moment.) That left Acme with a nice, round $1 million in net income for the year.

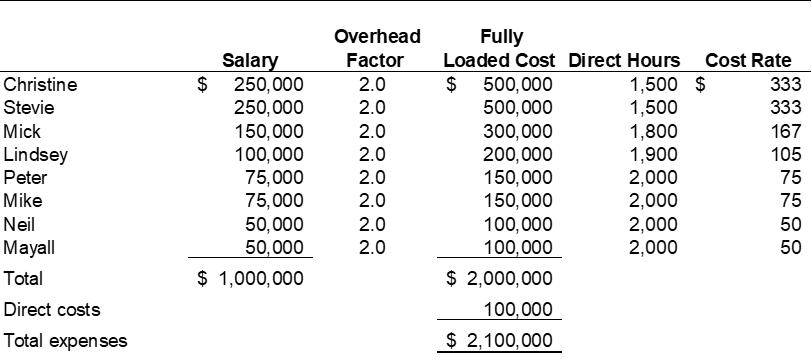

Now, let’s establish some fully loaded cost rates.

Step 1 Separate your expenses into three buckets: payroll, indirect costs, and direct costs.

Bucket 1 – Payroll For the purposes of this example, I recommend keeping payroll costs simple. Just use salaries. While certain things (like healthcare) don’t necessarily fluctuate with base pay, most other employee costs do (higher compensated people typically put more into their 401k plan, get bigger bonuses, etc.). So, keep your first attempt simple – just use base pay. In our example above, let’s assume total payroll comes to $1,000,000.

Bucket 2 – Indirect costs These are all of the other costs of your business that typically can’t be directly attributed to one project or client. Think things like rent and insurance. You can also think of this bucket as “overhead.” Let’s assume overhead is $1,000,000.

Bucket 3 – Direct costs These are costs that can be directly allocated to a project or client relationship, like client entertainment or company-paid, project-related travel. We’ll say these direct costs total $100,000.

If you’re keeping score at home, you’ll note that Bucket 1 + Bucket 2 + Bucket 3 = $2,100,000, which is our total Expenses in the inset above.

Step 2 Once you’ve (trigger warning – accountant word coming) disaggregated your costs, it’s time to determine your overhead factor. The formula is simple: Payroll, plus overhead, divided by payroll. Returning to our example above, remember Acme’s annual payroll was $1,000,000 and their overhead was $1,000,000. So, their overhead factor is 2.0 (1,000,000 + 1,000,000 ÷ 1,000,000 = 2.0).

Step 3 Now, allocate your overhead to your payroll costs by multiplying each employee’s salary by the overhead factor. This number is called the “fully loaded cost” of that employee. So, the fully loaded cost of an employee with a base salary of $50,000 would be $100,000 ($50K x 2.0 = $100K). Think of this number as a proxy for how much it costs you to employ that person.

Step 4 Now determine the cost rate. Divide the fully loaded cost by the total number of direct hours that you expect that employee to work in a year. Let’s assume that the employee with the fully loaded annual cost of $100K, mentioned above, works 2,000 direct hours per year. Recall that direct hours are hours spent working on revenue-generating activities – you know, stuff you can bill your clients for.

By that math, this employee’s hourly cost rate is $50 per hour ($100,000 ÷ 2,000 = $50). So, each direct hour of that team member’s time costs your company $50. Naturally, all this means you need to be billing your clients something more than $50 per hour for this particular employee’s time.

Let’s return to Acme LLC for a moment. Remember, they had expenses of $2.1 million each year. Here’s a breakdown of those expenses, allocated by payroll:

Note that the numbers in the Direct Hours column inversely correlate with salary. Your hires right out of college, with lower salaries, have lots to learn and they want to make their mark on the world – so they typically bill more hours during the year. Your more experienced, more well-compensated employees may have more responsibilities that can’t be directly mapped to one client, so they bill fewer direct hours, which factors into their fully loaded cost rate.

Also note that at the end of each period, your total time at cost (i.e., hours worked by each team member times their cost rate), plus any direct expenses, should equal (or be pretty darn close to) total expenses per your income statement.

Killer KPI – not a rapper or Bond villain

You can use this information as a killer KPI to reveal client (or project) profitability.

Take the number of hours that each team member worked on a client or project, times their fully loaded hourly rates, and arrive at the total cost of that project (or client) to your company. Then you take the fees you charged your client, minus this time at cost, and – presto! – you know how profitable that project or client is.

Now, instead of just looking at your income statement in broad brushstrokes, you can gain real insight into what contributes to your profitability, or doesn’t.

Let’s return to the accounting department of Acme LLC one last time:

We can see now that Acme did quite well on Project A (say, a fast-turnaround TV commercial where the client had few revisions), but they lost their shirt on Project B (a new website that saw countless, time-consuming revisions).

The best news? You can use this approach to look at individual projects, or client relationships as a whole, or both!

You can also use your loaded cost rates to help determine how much you may want to charge a prospective client for monthly recurring fees, or one-off projects.

Watch this space for more

We hope this has helped to demystify accounting for professional services firms.

Next time we talk cost accounting, we’ll discuss including certain disciplines or positions in overhead, and why 2,000 may not be the right number to use when determining your cost rates.

We’ll also cover time tracking and employee utilization. Don’t miss the deeper dive on this same subject, coming soon.

Let’s roll up our sleeves together

At Heath Advisory, we have significant experience helping marketing agencies and other professional firms design and implement these types of cost accounting procedures.

Contact us today to discuss if you could benefit from an analysis like the one described here – just a small part of what we bring to the table at Heath Advisory.